Who is most likely to buy a checking account from you? When might a customer be interested in a home equity loan? How far will someone drive to get a small business loan or investment advice? Answers to questions like these can dramatically improve the effectiveness of your marketing and sales efforts. And they are already at your fingertips (well, in your CIF, actually.)

What you are able to learn from your own customer data can drive tremendous efficiencies in marketing and sales if you know how to tap it.

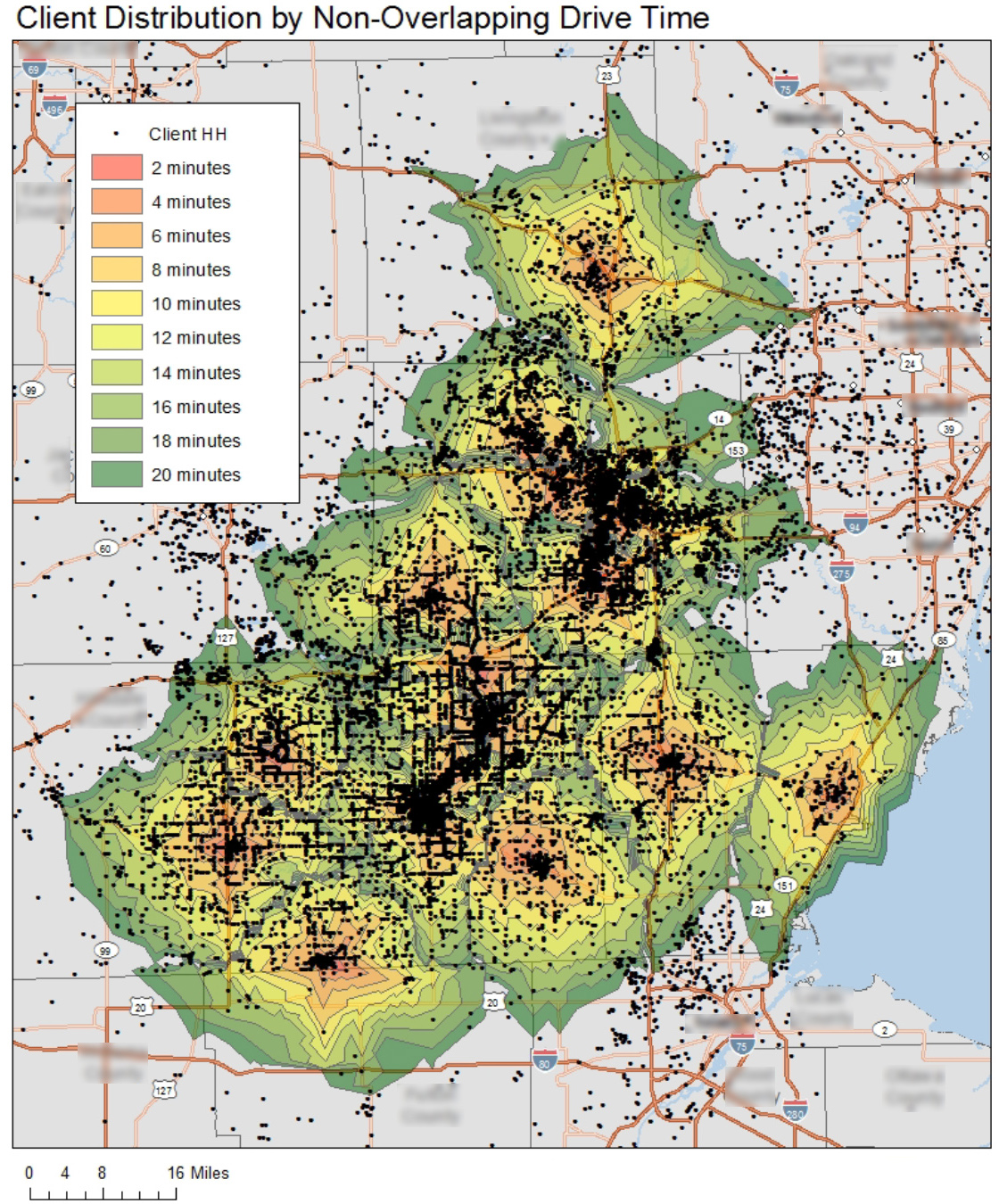

Galapagos uses a geostatistical model to analyze your customer database. The model is built on the product purchase and usage patterns of over 650,000 community bank customer households. Factors including socio-demographic profiles, product usage, proximity to a branch, and competitor density are built into the model to reveal the distribution of purchase probability of new customers.

In short, the model identifies prospective customers with an increased probability of purchase, allowing you to focus effort and resources on your best opportunities. The end result is an increase in ROI from marketing efforts and a more efficient sales process.

Example: Social Security Awareness Investment Campaign

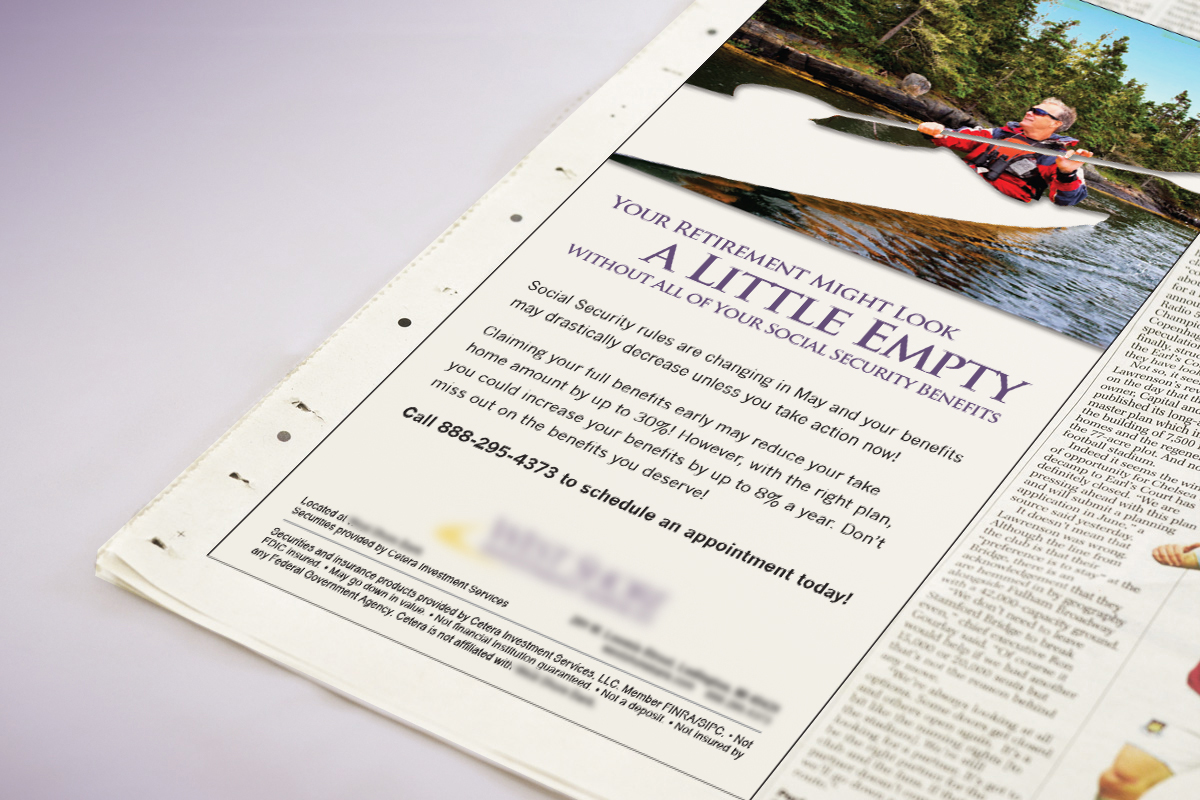

The 2015 Bipartisan Budget Act introduced several changes in Social Security claiming strategies. For one $350-million Midwest bank, this presented an opportunity to connect with customers while creating awareness of changes that could have a profound financial impact on their retirement futures. The Galapagos model was used to identify households to target with communications and sales calls:

- Customers in the 62 – 66 age range were most likely to be affected by the Social Security changes

- Socio-demographic factors were used to identify a profile of customers who, on one hand, had enough investable assets to be attractive as a prospect for the Investment Services group at the bank but who were not so wealthy that the impact of Social Security changes was a non-event

- Awareness emails were sent to the targeted customers

- Branch signage, announcing the Social Security changes, was posted in branches with a high concentration of likely prospects

- Issue awareness was increased by scheduling radio interviews for the bank’s Investment specialists

- Sales staff were trained on the key points of interest and the referral process

- Targeted calling efforts were launched with the goal of setting appointments for the bank’s investment specialists to discuss a retirement checkup

Results

The bank set 114 appointments during a two-week period, far surpassing its goal of 36 appointments for the campaign. 73% of these appointments were with customers targeted for the calling effort. Investment production generated from the campaign appointments doubled the bank’s production from the first quarter and generated a campaign ROI of $9.60-to-$1.